**China State Grid Launches New Batch of Smart Meter Bidding: Technological Upgrades Drive Industry Development**

**Bidding Data Overview: Continuous Optimization of Procurement Structure**

According to the bidding announcement, this round of electricity meter bidding totals 16.95 million units. In terms of annual data, the combined total for the three batches in 2025 is 66.40 million units. The bidding for collection terminals reached 39.3 thousand sets, including 136.3 thousand sets of intelligent fusion terminals; communication unit bidding amounted to 201 thousand units. It is worth noting that concentrators have been merged with intelligent fusion terminals for procurement starting from the second batch, reflecting the ongoing optimization of State Grid's equipment procurement strategy.

**Technological Development: New Meters Drive Industry Advancement**

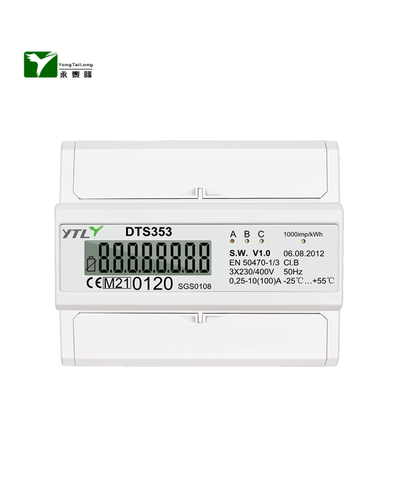

This bidding round fully adopts the new 2025 model smart meters, representing a significant application of the new generation of smart meters. The new meters feature multiple technical improvements: the adoption of power electronics technology in measurement principles helps enhance measurement accuracy and stability; the measurement range has been expanded to adapt to diverse grid environments and electricity consumption scenarios; functional integration has been improved, supporting more comprehensive data collection and analysis capabilities. These technical enhancements are expected to contribute to an increase in product value.

**Industry Impact: Emerging Development Opportunities**

The launch of the new meter cycle brings new development space for the industry chain. For electricity meter manufacturers, this may lead to the following impacts: continuous optimization of the product mix, with the proportion of new standard meters expected to rise; increased technical thresholds may create development opportunities for enterprises with R&D capabilities; service demand is likely to grow, potentially increasing needs for operation, maintenance, and data analysis services brought by the new meters.

From an industry cycle perspective, smart meters typically have a replacement cycle of 8-10 years. The previous concentrated replacement period was in 2015-2017, and a new replacement cycle is expected from 2025 to 2027. This bidding round aligns with this timeline.

**Observation Perspective: Focus on Enterprises with Technological Advantages**

Against the backdrop of the new meter cycle launch, attention may be given to enterprises with the following characteristics: sustained R&D capability to adapt to new technical requirements; stable production and delivery capacity; consistent performance in State Grid bidding. Some major meter enterprises, leveraging their technical accumulation and market experience, are expected to gain development opportunities in this new cycle.

**Future Outlook: Intelligentization Development Trend**

With the advancement of power system construction, the role of smart meters as crucial equipment for grid digitalization is expected to become more prominent. The new meters not only perform basic metering functions but will also support grid data collection tasks, providing support for applications such as the smart grid. In the long term, the meter industry may evolve toward a "device + service" model, offering enterprises more diversified revenue sources. With the development of new energy applications and the advancement of electricity market reform, the data value of smart meters is likely to receive greater attention.

The launch of State Grid's new meter bidding marks the industry's entry into a new development phase, making related technological upgrades and product updates noteworthy.

English

English 简体中文

简体中文

.png?imageView2/2/w/500/h/500/format/png/q/100)

.png?imageView2/2/w/500/h/500/format/png/q/100)

.png?imageView2/2/w/500/h/500/format/png/q/100)

.png?imageView2/2/w/500/h/500/format/png/q/100)