1、 Strategic Navigation in the Tide of Electricity Prices

When electricity shifts from planned distribution to market trading, electricity prices begin to fluctuate like tides. In provinces with active spot markets, the daily peak valley difference in electricity prices can reach over 0.8 yuan per kilowatt hour. This means that if companies can accurately schedule their electricity consumption behavior, they can capture significant arbitrage space in the price wave of the electricity market. The core tool for implementing this strategy is the smart meter that has evolved multidimensional perception capabilities - it has transformed from a traditional measuring instrument to a strategic navigator for enterprises to participate in electricity trading.

2、 Minute level perspective and price mapping

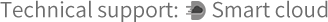

The core rule of market-oriented electricity trading lies in the strong correlation between price signals and time and space. The spot market forms a new trading electricity price every 15 minutes, and the time of use electricity price mechanism divides the whole day into multi-level periods such as peak, peak, off peak, and off peak. The demand response plan compensates users who actively reduce load during specific periods. This dynamic pricing system requires companies to establish minute level electricity monitoring capabilities, and traditional monthly settled mechanical meters are clearly unable to support such decisions. The new generation of smart meters solves this problem through a triple technological leap: firstly, its load curve recording accuracy is compressed from monthly granularity to minute level, and the electricity data is automatically frozen every 15 minutes, forming an energy consumption snapshot that is completely synchronized with spot trading. This high-frequency data collection enables enterprises to clearly see the mapping relationship between their own electricity consumption curve and real-time electricity prices. For example, when a sudden drop in photovoltaic output leads to a surge in electricity prices in the afternoon, the electricity meter will synchronously mark the sudden increase in energy consumption of each injection molding machine during that period.

3、 The Quantitative Revolution of Interruptible Load

The deeper value lies in the load adjustable potential model constructed by the electricity meter. Enterprises participating in demand response in electricity trading need to declare the interruptible load to the power grid in advance, and the declaration is based on the historical data analysis of the electricity meter. By deconstructing the energy consumption curve of enterprises, smart meters can identify the start stop patterns of non continuous production equipment. For example, in a stamping workshop of a certain automobile factory, there is an inherent standby load of 300kW during the lunch break, and the meter will automatically calculate the interruptible probability of this load based on the characteristics of the equipment, which reaches 92%. This quantitative evaluation directly translates into the "tradable limit" of enterprises in the demand response market. When the power grid issues a response invitation during the peak hours of the next day, enterprises can accurately bid based on the elastic load data provided by the electricity meter.

4、 Closed loop control with millisecond level response

The ultimate mission of electricity meters in electricity price response is to drive closed-loop control. When enterprises install smart meters with remote opening and closing functions, their participation in the market will be upgraded from manual intervention to automatic response. After receiving the real-time electricity price signal released by the power grid, the optimization algorithm built into the meter will initiate load scheduling based on a preset strategy: environmental control systems with low sensitivity to electricity prices can delay operation for 15 minutes, while precision workshops that must continue production will switch to self owned energy storage for power supply. This millisecond level response speed enables enterprises to capture fleeting low price windows. For example, a data center test showed that by automatically controlling load migration through electricity meters, the proportion of electricity purchases during low price periods in the spot market increased to 73%, and annual electricity expenses decreased by 12%. It is worth noting that such operations rely on the bidirectional communication capability and encrypted authentication protocol of the electricity meter to ensure the secure communication of control instructions between the power grid, electricity meter, and energy consuming equipment.

5、 Dynamic decoding of energy value stream

With the increasingly prominent nature of electricity commodities, the data recorded by electricity meters is generating derivative value. Under the mechanism of coordinated operation between the carbon market and the electricity market, the green electricity consumption collected by the electricity meter can be converted into carbon emission reductions for trading; In the auxiliary service market, enterprises can obtain additional benefits based on the load adjustment accuracy verified by electricity meters. When the metering data flow of the electricity meter is deeply coupled with the electricity trading flow and carbon quota flow, enterprises truly enter a new era of energy operation - there are no longer fixed electricity price labels, only dynamic value signals decoded in real time through smart meters.

English

English 简体中文

简体中文

.jpg?imageView2/2/w/500/h/500/format/png/q/100)

.png?imageView2/2/w/500/h/500/format/png/q/100)