I. Market Status and Growth Drivers

Expanding Market Scale

Russia's power equipment market is experiencing rapid growth across multiple sectors:

- Charging Pile Sector: The market size reached \(167.86 million in 2022 and is projected to surge to \)1.4433 billion by 2030, with a compound annual growth rate (CAGR) of 31.6%, making it the fastest-growing segment.

- Photovoltaic (PV) Energy Storage Market: Demand for PV battery energy storage in Moscow is particularly robust, with an expected annual growth rate of 30% in 2025, driven primarily by distributed energy needs in commercial and industrial sectors.

- Core Equipment Exports: In 2023, China’s exports of circuit breakers to Russia reached 90.039 million units, a year-on-year increase of 26.6%, directly reflecting the strong demand in Russia's power equipment market.

Policy-Driven Market Upgrades

The Russian government has introduced multiple policies to boost the power equipment market:

- New Energy Incentives: A 25% subsidy (up to 625,000 rubles) is provided for electric vehicle purchases, along with exemptions from import tariffs and purchase taxes, directly driving demand for supporting charging infrastructure.

- Energy Transition Plan: TheMaster Plan for Energy Facilities by 2042emphasizes increasing the share of wind and solar power, with over $100 billion earmarked for grid upgrades in the next decade.

- Localization Support Policies: Imported smart grid equipment enjoys a 15% tariff reduction and a 5-year VAT refund, but must comply with Russia’s mandatory GOST certification.

II. Competitive Landscape and Niche Market Opportunities

Market Player Dynamics

- International Brand Layout: Multinational companies such as Tesla, Volkswagen, and BYD are accelerating their penetration into the Russian market. Chinese enterprises have established first-mover advantages in PV modules (Longi, JinkoSolar) and energy storage systems.

- Rise of Local Enterprises: Russian companies like GAZ Group and Volga Group are increasing investment in electric vehicle R&D, potentially creating competition in mid-to-low-end markets in the future.

High-Potential Niche Segments

- Charging Network Construction: In remote areas, charging infrastructure coverage is insufficient, and there is an urgent demand for public charging stations along highways, presenting a market gap.

- PV Energy Storage Systems: Demand for distributed PV energy storage among commercial and industrial users is surging, with lithium-ion battery technology dominating mainstream applications.

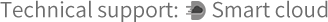

- Smart Grid Upgrades: The government’s push for grid digitalization has led to explosive growth in demand for smart meters and automated control equipment.

III. Profit Potential and Risk Challenges for Chinese Enterprises

Key Profit Drivers

- Cost Competitive Advantage: Chinese enterprises hold mature industrial chain advantages in core products such as PV modules, energy storage systems, and circuit breakers, with leading cost control capabilities compared to international peers.

- Policy Dividends: Tariff reductions and tax incentives lower market entry costs, while specialized exhibitions likeMoscow Power Grids Technology Exhibition (Power Grids)provide direct access to buyers.

- Supply Chain Cooperation Opportunities: Deep participation in the China-oriented power export supply chains of Russian State Grid and Far East Power Distribution Company can expand long-term cooperation.

Major Risk Factors

- Certification Barriers: GOST certification requires enterprises to prepare complete Russian-language technical documents, increasing initial compliance costs and time cycles.

- Infrastructure Constraints: Lagging charging network construction in remote areas may hinder equipment deployment and market penetration.

- Exchange Rate Volatility: Fluctuations in the ruble exchange rate could directly erode profits, necessitating effective financial hedging mechanisms.

IV. Recommendations for Market Entry Strategies

Diversified Channel Layout

- Exhibition-Driven Lead Generation: Leverage platforms like the 2025 Moscow Power Grids Technology Exhibition (December 2-4 at VDNH Exhibition Center) to connect with key buyers, following the successful model of TBEA, which signed $210 million in orders at previous exhibitions.

- Local Collaboration Empowerment: Establish joint ventures with Russian enterprises such as Russian State Grid to reduce certification, logistics, and local operation costs.

- Policy Project Participation: Actively engage in initiatives like the "Far East Advanced Development Zone" to enjoy property tax exemptions and electricity price subsidies.

Technology and Risk Management Solutions

- Technical Localization Adaptation: Develop power equipment tailored to Russia’s cold and high-humidity environments, drawing on TBEA’s experience in establishing transformer production bases in Russia.

- Product Portfolio Optimization: Promote integrated distributed PV energy storage systems to meet the energy needs of commercial and industrial users.

- Risk Hedging Mechanisms: Lock in costs through forward exchange contracts and initiate GOST certification procedures in advance to ensure product compliance and market responsiveness.

V. Conclusion

Russia’s power equipment market shows broad prospects, particularly in charging piles, PV energy storage, and smart grids. Chinese enterprises can leverage cost advantages, technological accumulation, and policy dividends to achieve substantial returns. Despite challenges such as certification barriers, inadequate infrastructure, and exchange rate volatility, effective strategies—including exhibition expansion, local collaboration, and participation in policy projects—can lower market entry barriers. As Russia’s energy transition advances, Chinese power equipment enterprises are poised to occupy a significant position in this emerging market and achieve long-term sustainable development.

# Outlook for Russia's Power Equipment Market: Opportunities and Challenges for Chinese Enterprises (建议配图:俄罗斯城市电网与光伏电站全景图,叠加中国电力设备企业logo元素) ## I. Market Status and Growth Drivers ### Expanding Market Scale Russia's power equipment market is experiencing rapid growth across multiple sectors: - **Charging Pile Sector**: The market size reached $167.86 million in 2022 and is projected to surge to $1.4433 billion by 2030, with a compound annual growth rate (CAGR) of 31.6%, making it the fastest-growing segment. - **Photovoltaic (PV) Energy Storage Market**: Demand for PV battery energy storage in Moscow is particularly robust, with an expected annual growth rate of 30% in 2025, driven primarily by distributed energy needs in commercial and industrial sectors. - **Core Equipment Exports**: In 2023, China’s exports of circuit breakers to Russia reached 90.039 million units, a year-on-year increase of 26.6%, directly reflecting the strong demand in Russia's power equipment market. ### Policy-Driven Market Upgrades The Russian government has introduced multiple policies to boost the power equipment market: - **New Energy Incentives**: A 25% subsidy (up to 625,000 rubles) is provided for electric vehicle purchases, along with exemptions from import tariffs and purchase taxes, directly driving demand for supporting charging infrastructure. - **Energy Transition Plan**: The *Master Plan for Energy Facilities by 2042* emphasizes increasing the share of wind and solar power, with over $100 billion earmarked for grid upgrades in the next decade. - **Localization Support Policies**: Imported smart grid equipment enjoys a 15% tariff reduction and a 5-year VAT refund, but must comply with Russia’s mandatory GOST certification. ## II. Competitive Landscape and Niche Market Opportunities ### Market Player Dynamics - **International Brand Layout**: Multinational companies such as Tesla, Volkswagen, and BYD are accelerating their penetration into the Russian market. Chinese enterprises have established first-mover advantages in PV modules (Longi, JinkoSolar) and energy storage systems. - **Rise of Local Enterprises**: Russian companies like GAZ Group and Volga Group are increasing investment in electric vehicle R&D, potentially creating competition in mid-to-low-end markets in the future. ### High-Potential Niche Segments - **Charging Network Construction**: In remote areas, charging infrastructure coverage is insufficient, and there is an urgent demand for public charging stations along highways, presenting a market gap. - **PV Energy Storage Systems**: Demand for distributed PV energy storage among commercial and industrial users is surging, with lithium-ion battery technology dominating mainstream applications. - **Smart Grid Upgrades**: The government’s push for grid digitalization has led to explosive growth in demand for smart meters and automated control equipment. ## III. Profit Potential and Risk Challenges for Chinese Enterprises ### Key Profit Drivers - **Cost Competitive Advantage**: Chinese enterprises hold mature industrial chain advantages in core products such as PV modules, energy storage systems, and circuit breakers, with leading cost control capabilities compared to international peers. - **Policy Dividends**: Tariff reductions and tax incentives lower market entry costs, while specialized exhibitions like *Moscow Power Grids Technology Exhibition (Power Grids)* provide direct access to buyers. - **Supply Chain Cooperation Opportunities**: Deep participation in the China-oriented power export supply chains of Russian State Grid and Far East Power Distribution Company can expand long-term cooperation. ### Major Risk Factors - **Certification Barriers**: GOST certification requires enterprises to prepare complete Russian-language technical documents, increasing initial compliance costs and time cycles. - **Infrastructure Constraints**: Lagging charging network construction in remote areas may hinder equipment deployment and market penetration. - **Exchange Rate Volatility**: Fluctuations in the ruble exchange rate could directly erode profits, necessitating effective financial hedging mechanisms. ## IV. Recommendations for Market Entry Strategies ### Diversified Channel Layout - **Exhibition-Driven Lead Generation**: Leverage platforms like the 2025 Moscow Power Grids Technology Exhibition (December 2-4 at VDNH Exhibition Center) to connect with key buyers, following the successful model of TBEA, which signed $210 million in orders at previous exhibitions. - **Local Collaboration Empowerment**: Establish joint ventures with Russian enterprises such as Russian State Grid to reduce certification, logistics, and local operation costs. - **Policy Project Participation**: Actively engage in initiatives like the "Far East Advanced Development Zone" to enjoy property tax exemptions and electricity price subsidies. ### Technology and Risk Management Solutions - **Technical Localization Adaptation**: Develop power equipment tailored to Russia’s cold and high-humidity environments, drawing on TBEA’s experience in establishing transformer production bases in Russia. - **Product Portfolio Optimization**: Promote integrated distributed PV energy storage systems to meet the energy needs of commercial and industrial users. - **Risk Hedging Mechanisms**: Lock in costs through forward exchange contracts and initiate GOST certification procedures in advance to ensure product compliance and market responsiveness. ## V. Conclusion Russia’s power equipment market shows broad prospects, particularly in charging piles, PV energy storage, and smart grids. Chinese enterprises can leverage cost advantages, technological accumulation, and policy dividends to achieve substantial returns. Despite challenges such as certification barriers, inadequate infrastructure, and exchange rate volatility, effective strategies—including exhibition expansion, local collaboration, and participation in policy projects—can lower market entry barriers. As Russia’s energy transition advances, Chinese power equipment enterprises are poised to occupy a significant position in this emerging market and achieve long-term sustainable development. (建议配图:中俄企业合作签约场景+电力设备技术参数图表,增强专业性与叙事性)# Outlook for Russia's Power Equipment Market: Opportunities and Challenges for Chinese Enterprises (建议配图:俄罗斯城市电网与光伏电站全景图,叠加中国电力设备企业logo元素) ## I. Market Status and Growth Drivers ### Expanding Market Scale Russia's power equipment market is experiencing rapid growth across multiple sectors: - **Charging Pile Sector**: The market size reached $167.86 million in 2022 and is projected to surge to $1.4433 billion by 2030, with a compound annual growth rate (CAGR) of 31.6%, making it the fastest-growing segment. - **Photovoltaic (PV) Energy Storage Market**: Demand for PV battery energy storage in Moscow is particularly robust, with an expected annual growth rate of 30% in 2025, driven primarily by distributed energy needs in commercial and industrial sectors. - **Core Equipment Exports**: In 2023, China’s exports of circuit breakers to Russia reached 90.039 million units, a year-on-year increase of 26.6%, directly reflecting the strong demand in Russia's power equipment market. ### Policy-Driven Market Upgrades The Russian government has introduced multiple policies to boost the power equipment market: - **New Energy Incentives**: A 25% subsidy (up to 625,000 rubles) is provided for electric vehicle purchases, along with exemptions from import tariffs and purchase taxes, directly driving demand for supporting charging infrastructure. - **Energy Transition Plan**: The *Master Plan for Energy Facilities by 2042* emphasizes increasing the share of wind and solar power, with over $100 billion earmarked for grid upgrades in the next decade. - **Localization Support Policies**: Imported smart grid equipment enjoys a 15% tariff reduction and a 5-year VAT refund, but must comply with Russia’s mandatory GOST certification. ## II. Competitive Landscape and Niche Market Opportunities ### Market Player Dynamics - **International Brand Layout**: Multinational companies such as Tesla, Volkswagen, and BYD are accelerating their penetration into the Russian market. Chinese enterprises have established first-mover advantages in PV modules (Longi, JinkoSolar) and energy storage systems. - **Rise of Local Enterprises**: Russian companies like GAZ Group and Volga Group are increasing investment in electric vehicle R&D, potentially creating competition in mid-to-low-end markets in the future. ### High-Potential Niche Segments - **Charging Network Construction**: In remote areas, charging infrastructure coverage is insufficient, and there is an urgent demand for public charging stations along highways, presenting a market gap. - **PV Energy Storage Systems**: Demand for distributed PV energy storage among commercial and industrial users is surging, with lithium-ion battery technology dominating mainstream applications. - **Smart Grid Upgrades**: The government’s push for grid digitalization has led to explosive growth in demand for smart meters and automated control equipment. ## III. Profit Potential and Risk Challenges for Chinese Enterprises ### Key Profit Drivers - **Cost Competitive Advantage**: Chinese enterprises hold mature industrial chain advantages in core products such as PV modules, energy storage systems, and circuit breakers, with leading cost control capabilities compared to international peers. - **Policy Dividends**: Tariff reductions and tax incentives lower market entry costs, while specialized exhibitions like *Moscow Power Grids Technology Exhibition (Power Grids)* provide direct access to buyers. - **Supply Chain Cooperation Opportunities**: Deep participation in the China-oriented power export supply chains of Russian State Grid and Far East Power Distribution Company can expand long-term cooperation. ### Major Risk Factors - **Certification Barriers**: GOST certification requires enterprises to prepare complete Russian-language technical documents, increasing initial compliance costs and time cycles. - **Infrastructure Constraints**: Lagging charging network construction in remote areas may hinder equipment deployment and market penetration. - **Exchange Rate Volatility**: Fluctuations in the ruble exchange rate could directly erode profits, necessitating effective financial hedging mechanisms. ## IV. Recommendations for Market Entry Strategies ### Diversified Channel Layout - **Exhibition-Driven Lead Generation**: Leverage platforms like the 2025 Moscow Power Grids Technology Exhibition (December 2-4 at VDNH Exhibition Center) to connect with key buyers, following the successful model of TBEA, which signed $210 million in orders at previous exhibitions. - **Local Collaboration Empowerment**: Establish joint ventures with Russian enterprises such as Russian State Grid to reduce certification, logistics, and local operation costs. - **Policy Project Participation**: Actively engage in initiatives like the "Far East Advanced Development Zone" to enjoy property tax exemptions and electricity price subsidies. ### Technology and Risk Management Solutions - **Technical Localization Adaptation**: Develop power equipment tailored to Russia’s cold and high-humidity environments, drawing on TBEA’s experience in establishing transformer production bases in Russia. - **Product Portfolio Optimization**: Promote integrated distributed PV energy storage systems to meet the energy needs of commercial and industrial users. - **Risk Hedging Mechanisms**: Lock in costs through forward exchange contracts and initiate GOST certification procedures in advance to ensure product compliance and market responsiveness. ## V. Conclusion Russia’s power equipment market shows broad prospects, particularly in charging piles, PV energy storage, and smart grids. Chinese enterprises can leverage cost advantages, technological accumulation, and policy dividends to achieve substantial returns. Despite challenges such as certification barriers, inadequate infrastructure, and exchange rate volatility, effective strategies—including exhibition expansion, local collaboration, and participation in policy projects—can lower market entry barriers. As Russia’s energy transition advances, Chinese power equipment enterprises are poised to occupy a significant position in this emerging market and achieve long-term sustainable development. (建议配图:中俄企业合作签约场景+电力设备技术参数图表,增强专业性与叙事性)

English

English 简体中文

简体中文

.jpg?imageView2/2/w/500/h/500/format/png/q/100)

.png?imageView2/2/w/500/h/500/format/png/q/100)